Transparency in Wealth Management: Building Trust in a Digital Age

In today's fast-paced digital world, the landscape of wealth management is undergoing a seismic shift and one of the central themes driving this evolution is transparency. It's not just a nice-to-have; it's the cornerstone of trust in financial services. With the rise of tech-savvy owners taking control of family offices and generational wealth transfer becoming more prevalent, the demand for transparency in wealth management has never been higher.

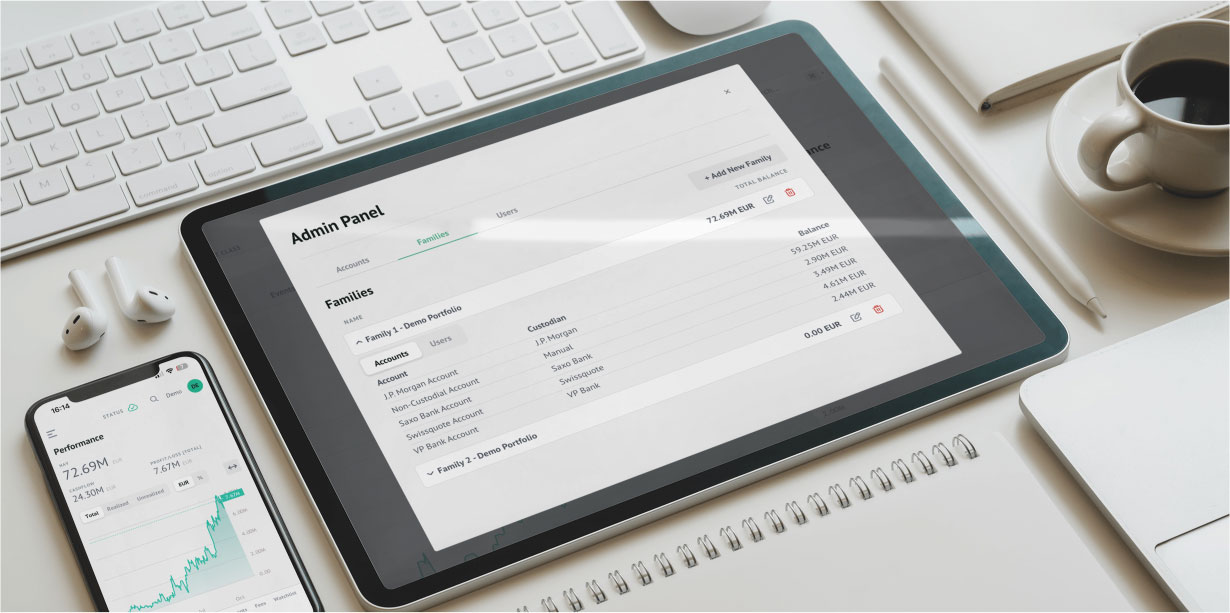

For family offices and their Ultimate Beneficial Owners (UBOs), clear insights into portfolio performance are not just expected—they're demanded. In this regard, wealth management solutions are pivotal in fostering trust by providing crystal-clear insights into portfolio performance.

The Foundation of Trust: Transparency and Accessibility

In the world of financial services, seeing is believing, and in that sense, transparency serves as the bedrock of trust in wealth management. UBOs tasked with steering the family fortune to newer horizons have a high level of expectation when it comes to the accessibility and transparency of their portfolios. They're also more literate with technology than previous generations.

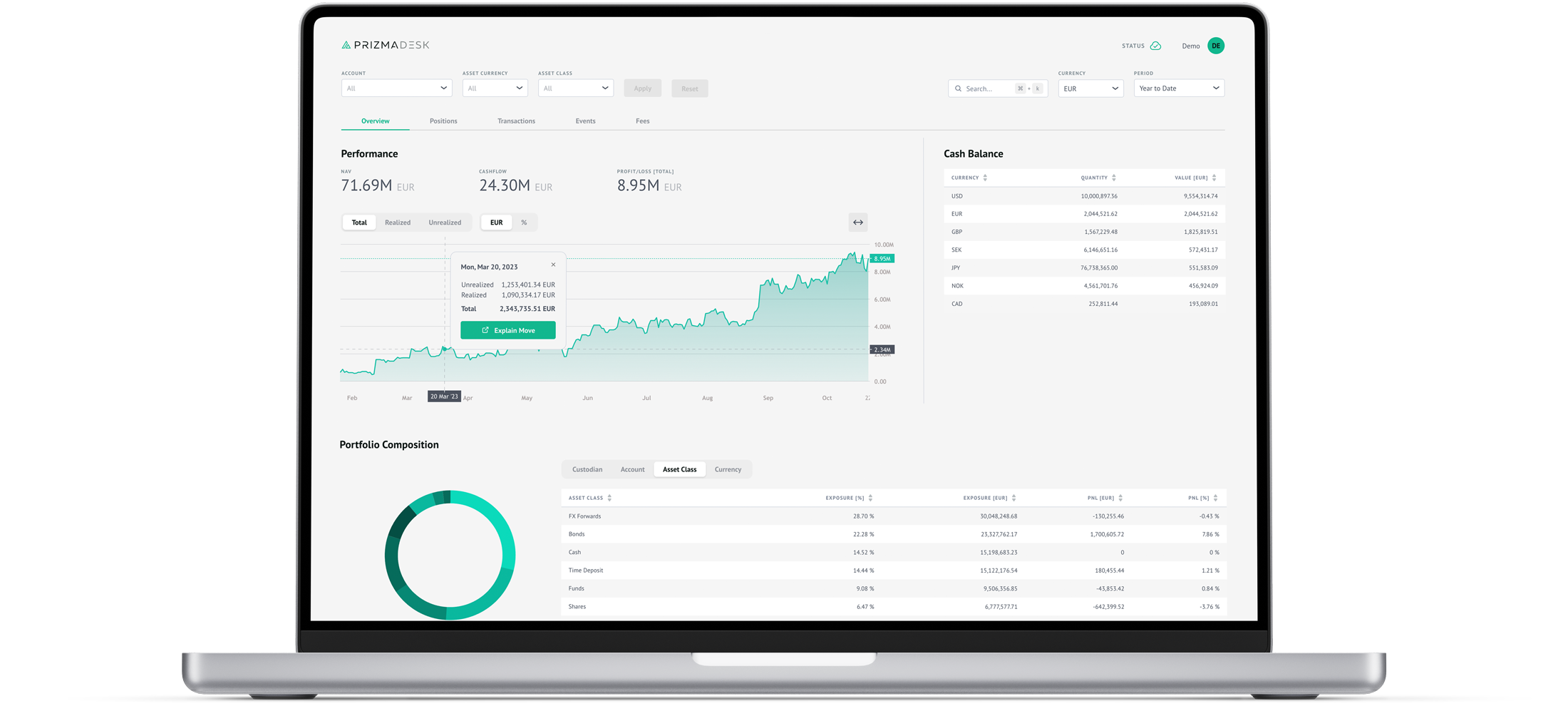

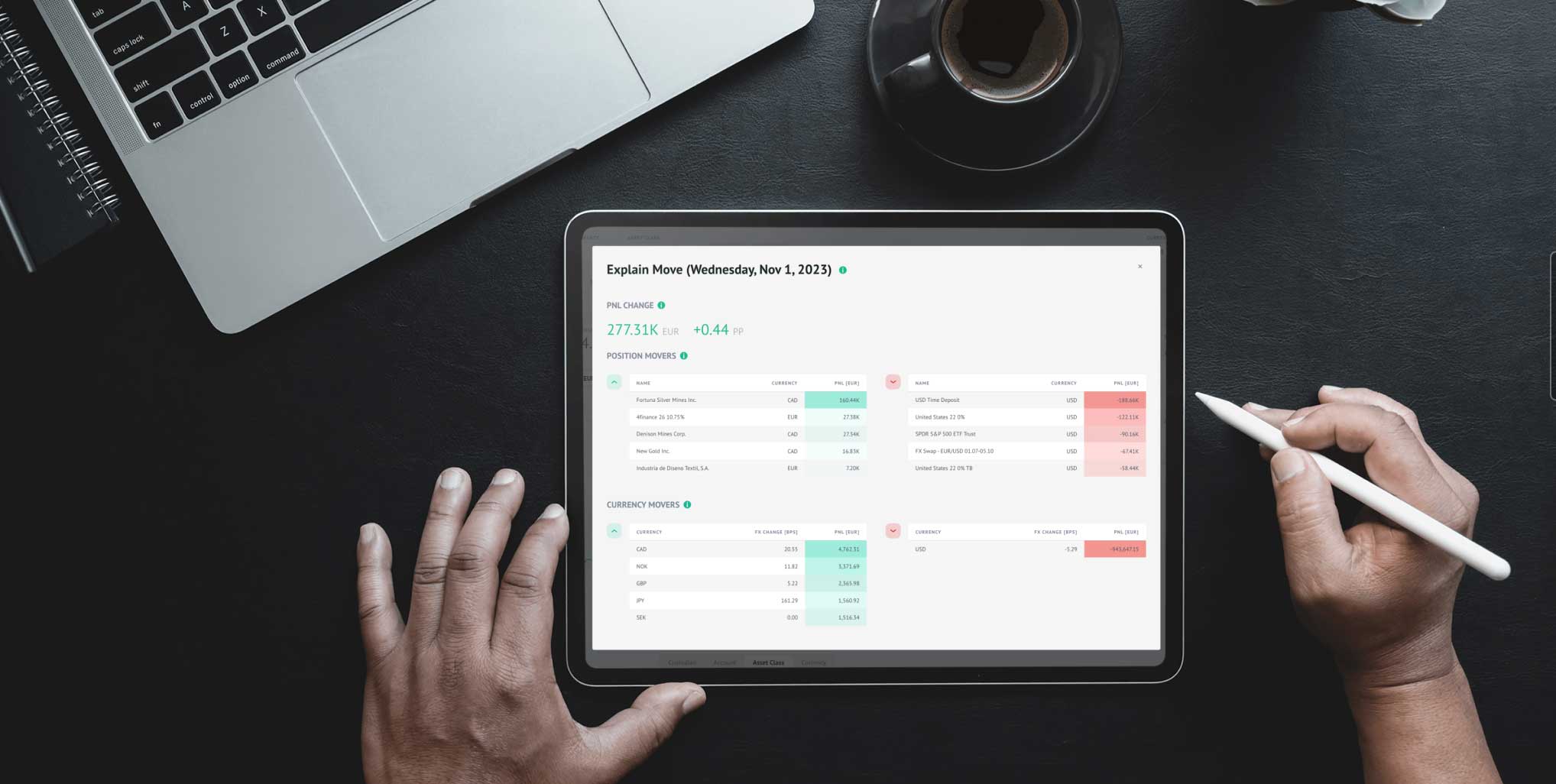

Modern wealth management solutions play an instrumental role in demystifying portfolio performance, offering real-time, accessible insights This transparency is not merely about data provision; it is about presenting information in an intelligible and actionable manner.

1. Real-Time Data Accessibility: Gone are the days of waiting for quarterly reports. Wealth management solutions today offer immediate access to financial data, allowing for prompt and informed decision-making.

2. Crystal Clear Insights: Wealth management solutions not only provide data but also present it in a clear and easy-to-understand manner. This, in turn, provides actionable insights that family offices can use to make informed investment decisions.

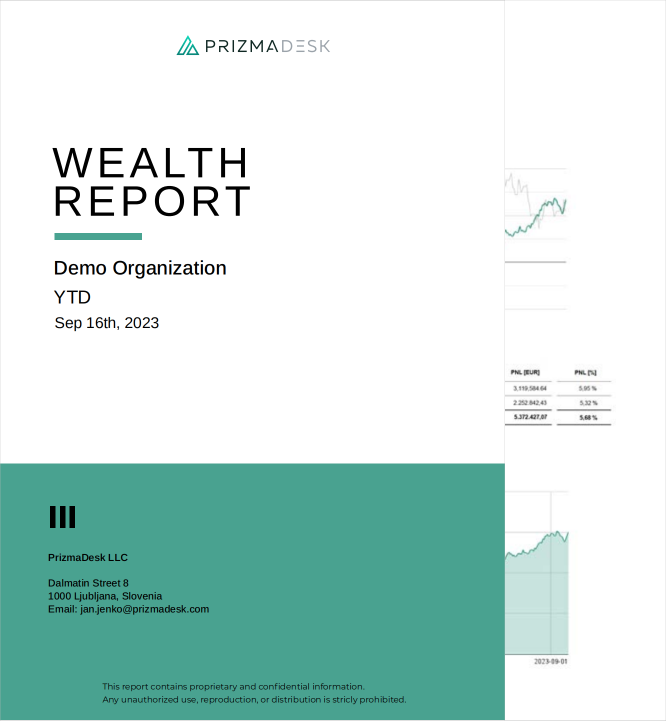

3. Customizable Reporting: Tailored reporting tools enable UBOs to view their portfolio in a way that aligns with their specific interests and needs, enhancing understanding and engagement.

Transparent Ethics and Compliance

Aside from fostering trust and meeting the expectations of UBOs, transparency in wealth management plays a crucial role in ensuring ethical and compliant operations. With greater visibility into portfolio performance and transactions, family offices can identify any red flags or potential conflicts of interest early on.

1. Meeting Regulatory Requirements: Transparent reporting enables family offices to comply with regulatory requirements, avoiding costly penalties and reputational damage.

2. Responsible Data Handling: Ensuring that data is used ethically and responsibly is crucial. This includes clear communication regarding investment strategies and financial decisions.

3. Sustainable and Ethical Investing: With a new generation of UBOs focusing on sustainable and ethical investing, wealth management solutions must align with these values, providing insights into how wealth is being invested responsibly.

Privacy and Control: Cornerstones of Trust

Privacy and control are critical in establishing trust in wealth management. Family offices and those who manage them require assurance that their financial information is handled with the utmost confidentiality and that they have control over their data.

1. Highly Secure Data Protection: Wealth management solutions offer advanced security measures to safeguard the privacy of client data, ensuring that sensitive information is protected from unauthorized access.

2. Client Control Over Data: Providing clients with control over their data, including how it is used and shared, is essential in building trust.

Security and Reliability: Ensuring Trust in Technology

One of the most crucial elements of engendering trust in wealth management is the security and reliability of the platform. Wealth management solutions must demonstrate robust security measures and reliable performance to maintain the confidence of their users.

1. Robust Security Protocols: Implementing advanced security protocols to protect against cyber threats is a non-negotiable aspect of wealth management solutions.

2. Consistent and Reliable Performance: Ensuring that the platforms are consistently reliable, with minimal downtime and accurate performance tracking, is key to maintaining confidence in the solution.

Generational Wealth Transfer: A New Breed of UBOs

As wealth passes from one generation to the next, the baton isn't the only thing that's changing hands. Expectations are too. The new generation of UBOs is tech-savvy and data-driven. They're not just looking for numbers; they're after the story behind them. These UBOs seek not just financial stewardship but also a partnership that aligns with their values and expectations in a digital world.

This generation has grown up in a digital world. They're used to having information at their fingertips, and they expect the same from their wealth management solutions. They also view wealth differently. They're not just interested in growth; they're interested in how that growth is achieved. Sustainable investing, ESG factors—you name it, they're looking for it.

The Role of Wealth Management Solutions

So, where do wealth management solutions fit into all this? They're the bridge between the old world and the new. They bring transparency to the forefront, making it easier for those who manage significant portfolios to build and maintain the trust of their clients.

This new generation of wealth owners, being more technologically adept, demands a higher degree of transparency and digital sophistication from those who manage their wealth. Wealth management solutions have evolved to meet these demands, providing a holistic approach that combines seamless accessibility, ethics, privacy, and security to foster trust between family offices and their clients.

Ultimately, this level of transparency serves as the foundation for trust in wealth management, not just for today's generation but also for those to come.

About PrizmaDesk

PrizmaDesk is a wealth analytics platform that provides a full-picture view of your entire investment portfolio. With PrizmaDesk, you get a single source of accurate, up-to-date investment data, empowering you with total control, transparency, and peace of mind.

Discover how PrizmaDesk can assist in safeguarding your family office for the future. Request demo access or schedule a conversation with one of our wealth technology experts to join the community of clients who have harnessed the complete potential of their wealth today.

Receive Insights on Wealth Technology

Stay informed with the latest wealth tech insights and industry best practices delivered directly to your email.