Navigating Uncertainty: The Role of a Wealth Management Solution

In today's volatile economic climate, the ability to manage portfolio risk effectively is more than a skill – it's a necessity.

With rapid economic shifts and geopolitical uncertainties increasingly becoming the new normal, the need for robust risk management in wealth management has never been more critical. For wealth managers and family offices, where the stakes involve not just wealth but a legacy, this rings especially true.

This is easier said than done, however. The sheer volume of data and ever-changing market conditions can make it challenging to identify and mitigate risks effectively. In response to this, PrizmaDesk's next-generation wealth analytics platform has been specifically designed to help wealth managers and family offices navigate complex and unpredictable market environments. Ultimately, this gives them a much more holistic understanding of their portfolio and offers a comprehensive solution to minimize risk.

Comprehensive, Real-time Portfolio Overview

In the world of wealth management, staying informed equates to staying ahead. PrizmaDesk's wealth management solution ensures that you are consistently on the cutting edge by providing real-time alerts on portfolio adjustments, impending market events, and significant financial developments. With these timely updates, those responsible for managing the portfolios of high-net-worth clients can swiftly respond to market fluctuations, capitalizing on opportunities as they arise and mitigating risks before they become problematic.

Being alerted to upcoming market events allows for strategic planning and proactive decision-making, rather than reactive moves in response to market shifts. This level of informed oversight is invaluable for maintaining and growing wealth in an ever-changing financial landscape, ensuring that your investment strategy remains robust, relevant, and aligned with both short-term realities and long-term objectives.

Efficient Portfolio Mandate Tracking

Effective risk management is not just about responding to market changes, however; it's also about ensuring compliance with established investment mandates. PrizmaDesk addresses this by offering an advanced portfolio mandate tracking system. This system not only monitors compliance with investment guidelines but also proactively alerts managers to potential deviations, ensuring that all actions are aligned with clients' objectives. This preemptive approach ensures that risk mitigation is not just reactive but a built-in part of the investment process, aligning daily operations with the overarching investment philosophy.

This level of proactive compliance significantly reduces legal and reputational risks while paving the way for sustainable growth. By integrating this solution, PrizmaDesk helps your organization maintain a high level of vigilance, effortlessly adapting to evolving regulatory landscapes and ensuring that your wealth management practices not only meet current standards but are also positioned to adapt to future changes. This prescient approach to compliance is key to thriving in the complex world of wealth management, where integrity and adherence to regulations are just as crucial as financial performance.

Dynamic Watchlist Feature

Agility is key in today's wealth management, and PrizmaDesk's dynamic watchlist feature offers asset managers a powerful tool to stay ahead. This feature allows for real-time tracking of various assets, providing immediate alerts on critical price movements and market changes. Such timely information is crucial for staying ahead of market trends and making informed decisions quickly. It's also a critical feature for managing and reducing risks when dealing with the uncertainties of today's financial markets.

Not only does this feature offer a means for staying ahead of trends, and lessening investment risks, but it also helps reduce the burden on fund managers by automating some portfolio monitoring tasks. This allows for more efficient use of time and resources, freeing up valuable capacity to focus on other critical areas of wealth management.

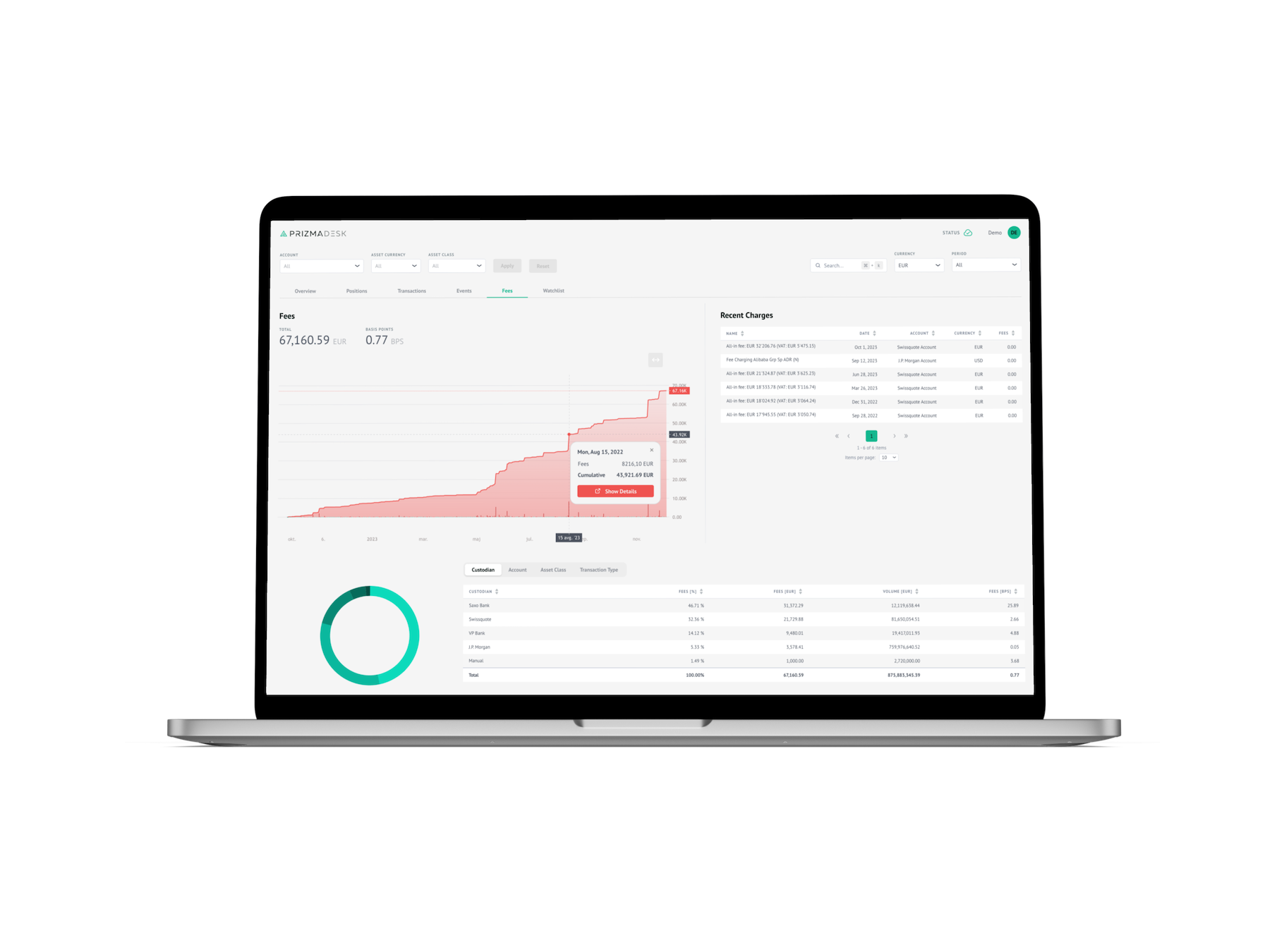

Transparent Custodian Fees Breakdown

In wealth management, every expense impacts the bottom line. PrizmaDesk offers financial clarity through its transparent custodian fees breakdown, a feature seamlessly integrated into its unified dashboard. This feature provides a clear picture of the costs associated with each transaction and banking relationship.

This dashboard centralizes all asset types, providing a comprehensive view of the fees associated with each custodian and transaction. This level of transparency is crucial for effective decision-making, allowing stakeholders to easily compare costs, understand the financial implications of their custodial choices, and collaborate more effectively. By laying out all fees in an accessible and understandable format, PrizmaDesk not only fosters informed financial management but also enhances communication and collaboration among all stakeholders involved in the wealth management process.

"Today's financial landscape is volatile and unpredictable, making robust risk management an essential aspect of managing wealth. PrizmaDesk's wealth management solution offers a comprehensive, efficient, and transparent approach to risk management. In an unpredictable world, it is an essential tool for family offices, asset managers, and high-net-worth individuals, helping them navigate the complexities of wealth management with confidence and precision."

About PrizmaDesk

PrizmaDesk is a wealth analytics platform that provides a full-picture view of your entire investment portfolio. With PrizmaDesk, you get a single source of accurate, up-to-date investment data, empowering you with total control, transparency, and peace of mind.

Discover how PrizmaDesk can assist in safeguarding your family office for the future. Request demo access or Schedule a conversation with one of our wealth technology experts to join the community of clients who have harnessed the complete potential of their wealth today.

Receive Insights on Wealth Technology

Stay informed with the latest wealth tech insights and industry best practices delivered directly to your email.