How a Wealth Management Solution Reduces Manual Errors

In the intricate world of wealth management, particularly within the realm of family offices, precision is not merely a goal — it is a necessity. High-net-worth individuals and families entrust their financial legacies to wealth managers, who must juggle an array of complex tasks with meticulous accuracy. With large amounts of wealth at stake, any error, no matter how small, can have significant consequences.

However, the human element inherent in these processes is susceptible to error, and even the most minor miscalculation can have outsized consequences. This is where the latest advancements in wealth management platforms demonstrate their critical value, offering a transformative solution to a historical challenge.

In this article, we will highlight how manual errors can put wealth at risk and how a wealth management solution mitigates manual errors.

How Manual Errors Can Put Wealth at Risk

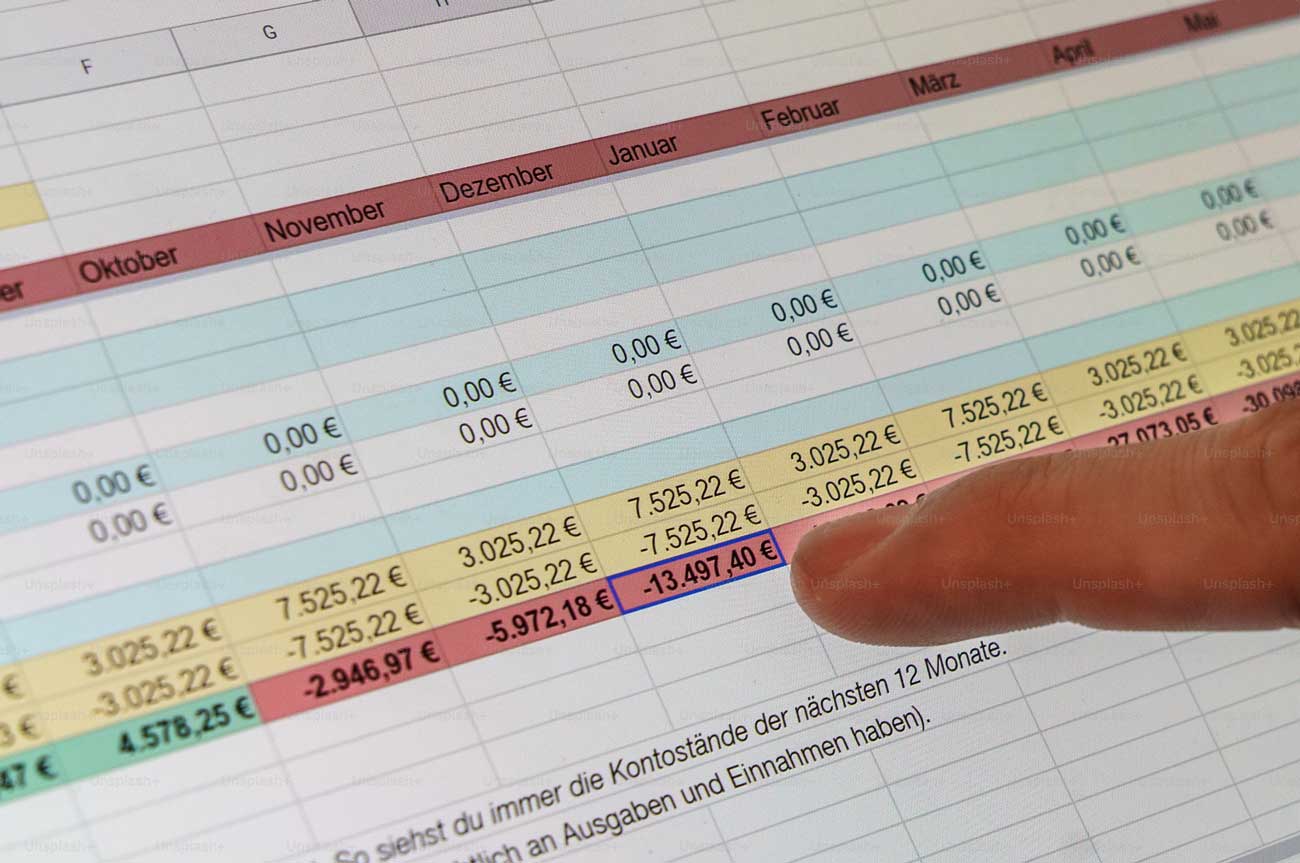

Time-consuming and tedious manual processes have historically been a hallmark of traditional wealth management. From manual data entry to performance calculations, the sheer volume of tasks that must be completed manually leaves ample room for human error to creep in. Something as simple as an incorrect input or calculation can have significant ramifications on a family office's portfolio performance and ultimately, its bottom line. Furthermore, the manual nature of these processes can also lead to delays and inaccuracies in reporting, hindering wealth managers' ability to make informed decisions promptly.

The repercussions of these errors are multifaceted:

1. Financial Implications: Minor errors can lead to substantial discrepancies in performance calculations, which can result in significant financial losses. Additionally, these mistakes can also impact the tax planning and compliance aspect of wealth management, leading to unexpected costs for wealthy clients.

2. Reputational Damage: Inaccuracies and delays in reporting due to manual errors can erode client trust and damage the reputation and credibility of wealth managers. If these types of mistakes become a recurring issue, it can deter potential clients from entrusting their wealth to the management firm.

3. Regulatory Repercussion: The financial sector's stringent regulatory environment leaves little room for error, and any mistake can result in significant penalties and even legal action. Compliance failures due to manual errors can lead to regulatory scrutiny, putting the entire firm's operations at risk.

4. Operational Inefficiencies: Manual processes are not only prone to errors but also time-consuming and resource-intensive. Because of this, manual data entry and reconciliation can end up straining operations, taking valuable time away from more critical tasks that could better serve clients.

5. Opportunity Costs: Errors can also lead to missed investment opportunities or suboptimal asset allocation, adversely affecting wealth accumulation over time. Additionally, the time and resources spent on manual tasks could be better allocated to developing more robust wealth management strategies, generating more significant returns for clients.

How a Wealth Management Solution Mitigates Manual Errors

Given the high stakes involved, it is no surprise that wealth managers are turning to technology to streamline their processes and mitigate the risk of human error. A powerful wealth management solution is far superior to traditional methods and is engineered to mitigate the risk of manual errors through a suite of sophisticated features.

1. Automation

Automation is at the heart of modern wealth management solutions. Utilizing advanced software code code and systems, complex tasks like data entry, reconciliation, and performance calculations are automated with remarkable efficiency. This powerful approach enables the automation of tasks with unprecedented accuracy, significantly reducing the risk of manual errors. This is accomplished with remarkable speed, saving time and resources, and ensuring a higher degree of reliability in financial management processes.

2. Real-Time Data Synchronization

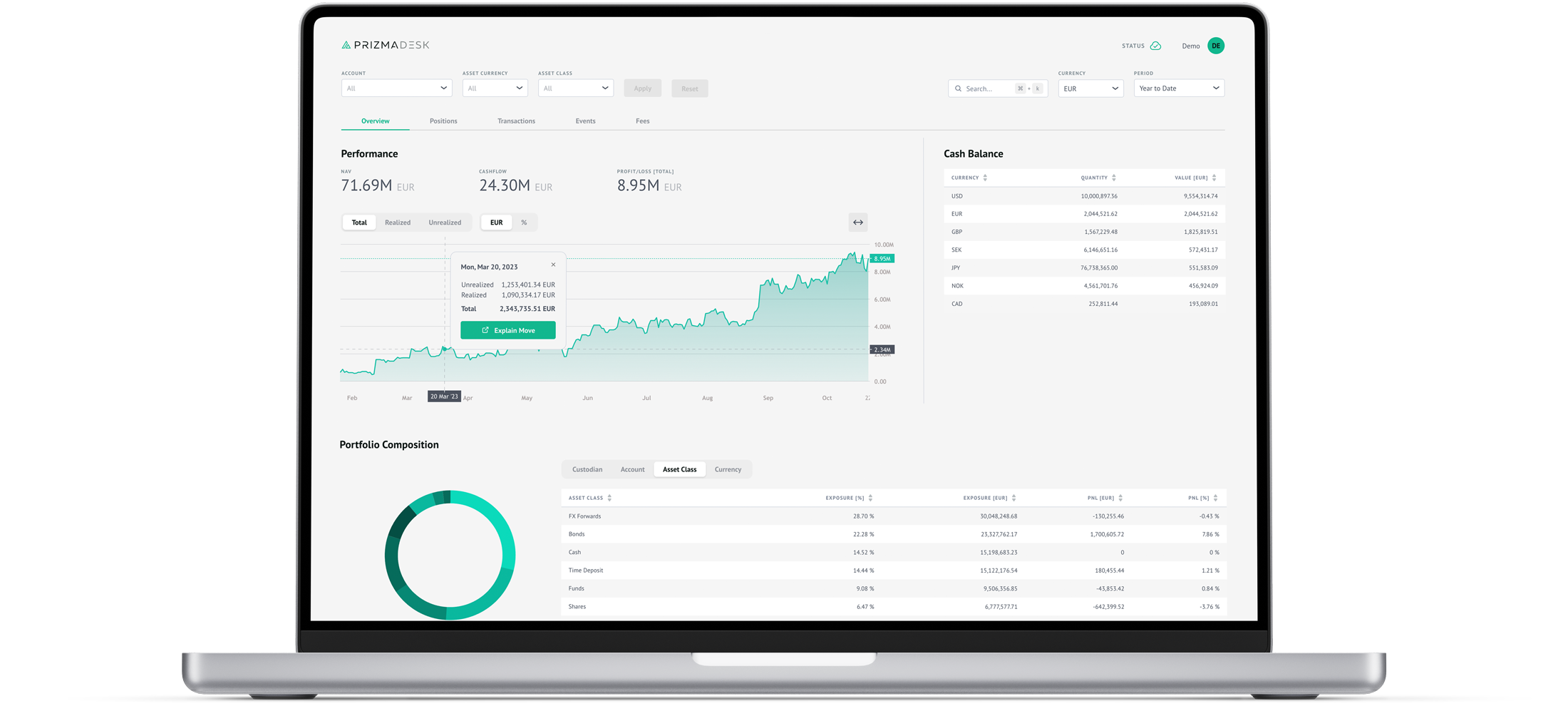

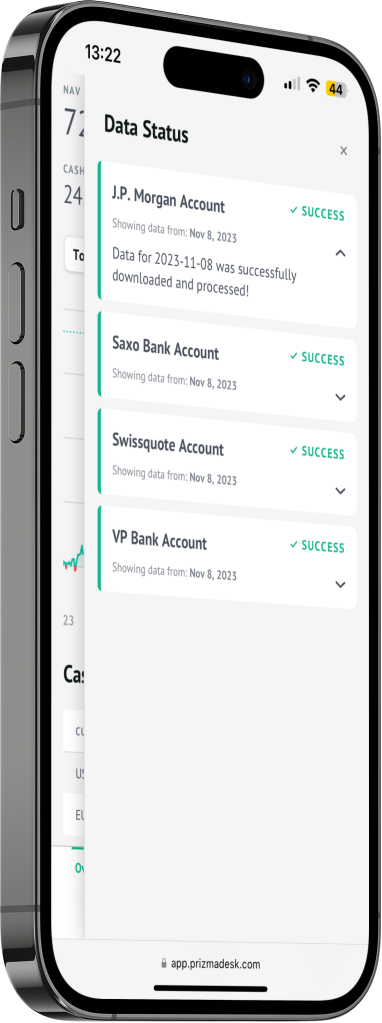

A robust wealth management solution offers comprehensive data synchronization across multiple platforms, ensuring that all relevant financial information is accounted for and reconciled in real time. This provides access to current, accurate portfolio information, which is crucial for making informed decisions and mitigating the risk of making portfolio-related decisions based on outdated information. Advanced Risk Management A critical component of wealth management, risk management is inherently prone to human error. A modern solution leverages sophisticated data analysis capabilities to identify potential risks, preempt potential errors, and recommend appropriate mitigation strategies. This not only helps reduce the number of errors but also improves the overall quality of decision-making.

3. Precision in Calculations

Wealth management solutions feature robust calculation engines that perform complex calculations with unparalleled accuracy. By automating these tasks, the risk of manual errors is significantly reduced, minimizing losses, and leading to precise performance and tax calculations.

4. Custom Reporting

A powerful wealth management solution offers customizable reporting dashboards tailored to the specific needs of family offices. This helps streamline the reporting process, reducing the risk of inaccuracies and delays, while also providing clients with a holistic view of their portfolio performance.

5. Document Management

Document management is a critical aspect of wealth management, and even minor errors in reporting can have significant consequences. Wealth management solutions offer robust document management capabilities that automatically identify inaccuracies, ensuring the integrity and accuracy of client statements.

6. Collaborative Ecosystem

A wealth management solution also provides a platform where all stakeholders, including family office owners, asset managers, and financial professionals, can access the same data in real-time. This promotes synergy amongst all parties and ensures that everyone is working with the most up-to-date information to minimize errors.

The Competitive Edge

In the realm of wealth management, minimizing manual errors is not merely an advantage — it is essential for maintaining client trust and satisfaction. With complex portfolios and constantly changing market conditions, the potential for errors is significant. A wealth management solution then becomes more than just a tool; it is a strategic partner to family offices in the pursuit of wealth preservation and growth. By leveraging these technological advancements, wealth managers are equipped to navigate the complexities of their clients' financial landscapes with confidence and precision.

About PrizmaDesk

PrizmaDesk is a wealth analytics platform that provides a full-picture view of your entire investment portfolio. With PrizmaDesk, you get a single source of accurate, up-to-date investment data, empowering you with total control, transparency, and peace of mind.

Discover how PrizmaDesk can assist in safeguarding your family office for the future. Request demo access or schedule a conversation with one of our wealth technology experts to join the community of clients who have harnessed the complete potential of their wealth today.

Receive Insights on Wealth Technology

Stay informed with the latest wealth tech insights and industry best practices delivered directly to your email.