How a Wealth Management Solution Increases Efficiency and Performance

In the realm of wealth management, the digital age has brought a significant change. Family offices and financial professionals are faced with the challenge of managing increasingly complex portfolios of assets. The need for sophisticated tools to manage, analyze, and secure vast financial portfolios has never been more pronounced, which has given rise to a new generation of wealth management solutions.

Wealth management solutions provide family offices with the tools they need to manage their investments through a single platform, streamlining the process and providing greater insight into portfolio performance. There are multiple ways in which a wealth management solution can benefit family offices and financial professionals.

In this article, we will highlight the top 5 benefits of using wealth management solutions:

1. Centralized Data Storage for Enhanced Wealth Assessment

One of the most significant challenges to managing large portfolios is consolidating data from various sources. Disparate systems and manual processes risk of errors. to fragmented data, increasing the risk of errors.

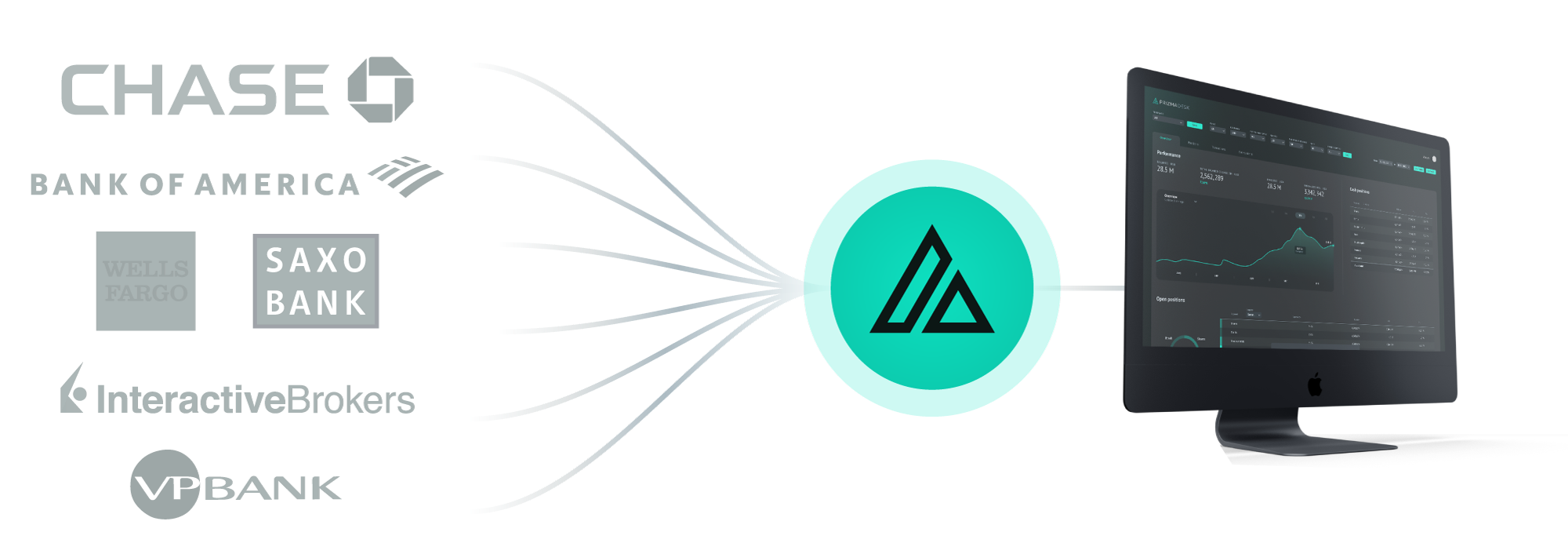

A robust wealth management solution consolidates all financial data in one platform. This means that family offices and financial professionals have access to a centralized database, providing a comprehensive overview of the client's finances. This consolidation eliminates the need to sift through multiple spreadsheets and statements, streamlining the process and allowing for more efficient decision-making. It also ensures more accuracy and promotes collaboration, as all parties have access to the same up-to-date information.

2. Automated Data Entry and Real-time Portfolio Performance Reporting

Manual aggregation from various sources can be time-consuming and prone to human error. A wealth management solution automates the process, reducing the risk of errors and allowing for more efficient data entry.

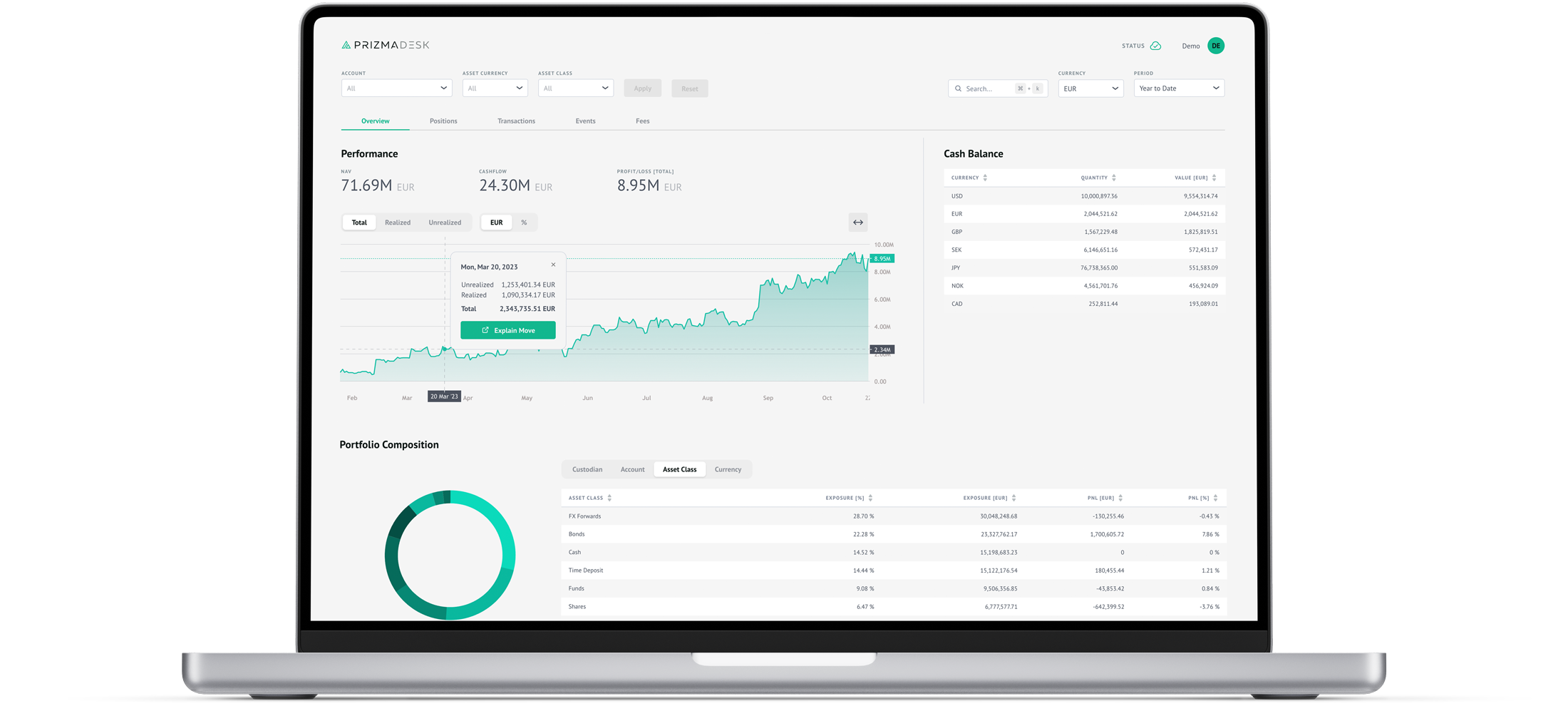

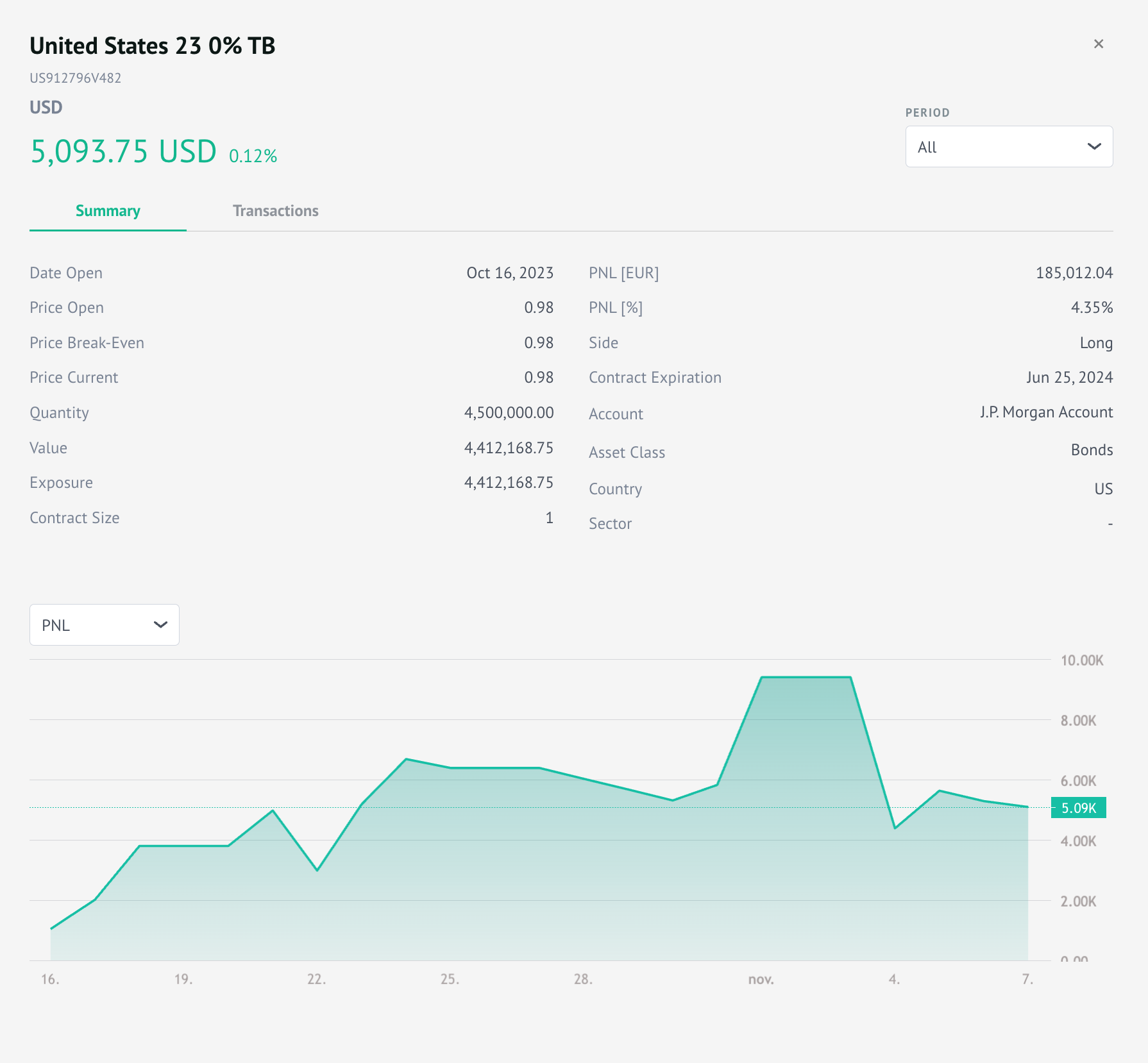

Furthermore, a wealth management solution provides real-time portfolio performance reporting, giving financial professionals and those they serve up-to-date insights on their investments. This feature enables proactive decision-making by identifying trends and highlighting areas for improvement or potential risks. Real-time reporting also allows for faster reactions to market changes, ensuring portfolios remain aligned with investment goals.

3. Powerful Security for Trustworthy Wealth Management

For family offices, security is a top priority and with the rise of digitalization, financial assets are increasingly vulnerable to hacking or other malicious activities. In their report, State of Ransomware in Financial Services 2023, Sophos revealed that the rate of ransomware attacks in financial services continues to go up; from 55% in 2022 to 64% in this year’s study. As such, one of the biggest advantages of wealth management solutions is that they provide enhanced data security measures to protect against cyber threats.

A robust wealth management solution prioritizes data security and provides multi-factor authentication, encryption, and continuous monitoring to safeguard sensitive information. This safeguards data and gives family offices peace of mind, knowing that their portfolios are protected from potential breaches.

4. Data Insights for Advanced Wealth Analytics

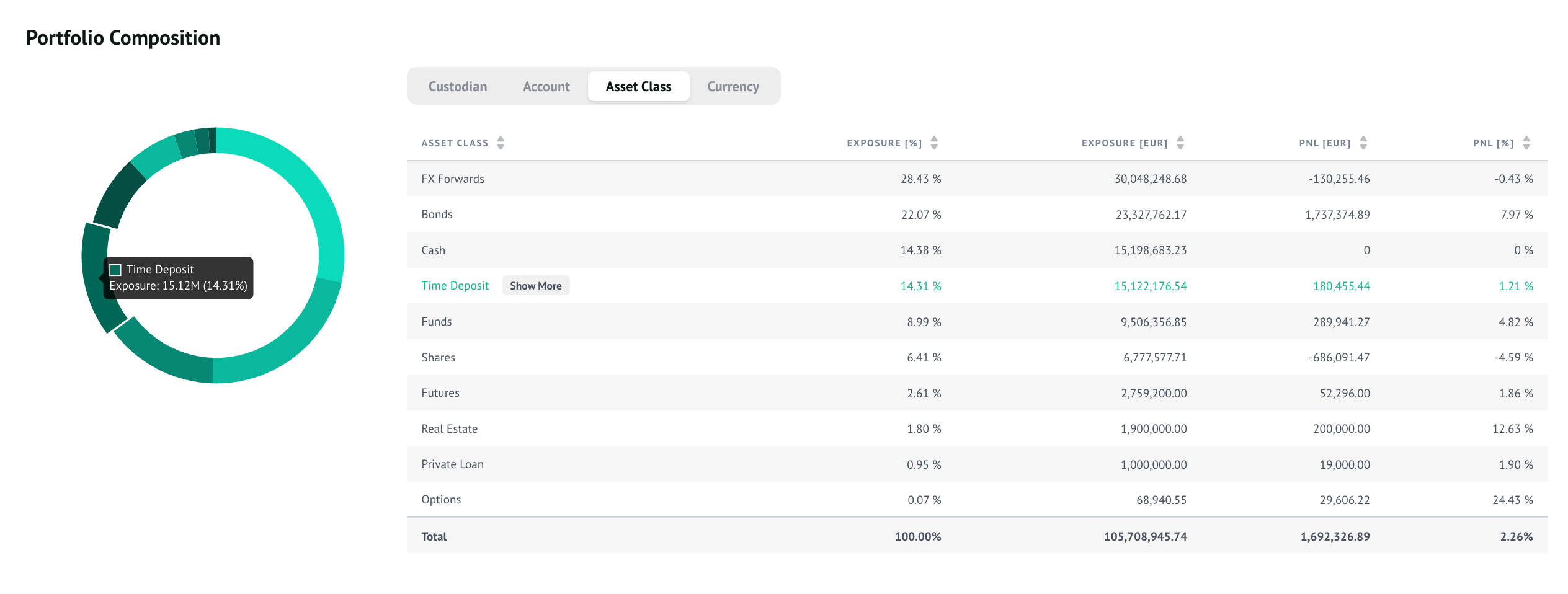

Wealth management solutions do more than just store and consolidate data; they also provide in-depth analytics that otherwise would be challenging to obtain. By analyzing vast amounts of data, these solutions can identify patterns, trends, and opportunities that may otherwise go unnoticed.

Having access to this level of analytics allows family offices to optimize their investment strategies and achieve better results. It also provides financial professionals with the necessary information to offer tailored advice that aligns with client goals. Ultimately, this empowers more informed decision-making and helps family offices and those who serve them to proactively address potential challenges.

5. Unparalleled Transparency in Wealth Management

A key benefit of contemporary wealth management solutions is the transparency they offer. By providing a centralized platform for all financial data and insights, family office owners (UBOs) can get real-time, accurate assessments of their portfolio's performance at any given time.

This level of transparency is invaluable, serving as a single source of truth for all parties involved. With all assets consolidated in one place, UBOs have a clear overview of their asset managers' trading activities and the performance of those trades. In the complex world of wealth management, it also helps promote accountability and credibility, which are crucial in cultivating strong and lasting relationships with clients.

Increased Efficiency and Reduced Risk

Ultimately, all these factors contribute to increased efficiency in wealth management, saving time and resources while maximizing portfolio performance. Historically, one of the biggest drawbacks of managing large portfolios has been the manual processes involved. Errors can result in significant financial setbacks for clients, from incorrect investment choices to unforeseen tax implications and compliance violations. Inaccuracies can also result in overlooked investment opportunities, potentially hindering the optimal performance of the portfolio. Such mistakes not only impact the client but can also damage the reputation of financial professionals.

By utilizing a wealth management solution, family offices and financial professionals can mitigate these risks. As the complexity of financial portfolios continues to grow, the need for a comprehensive wealth management solution will only increase. From streamlining data consolidation and security to providing insightful analytics and facilitating communication, these solutions offer numerous benefits that ultimately lead to improved portfolio performance. By embracing this technology now, financial professionals can position themselves as trusted advisors in the industry. Likewise, family offices can ensure their assets are managed efficiently and effectively, helping them achieve their financial goals and giving them peace of mind and confidence in their investments.

About PrizmaDesk

PrizmaDesk is a wealth analytics platform that provides a full-picture view of your entire investment portfolio. With PrizmaDesk, you get a single source of accurate, up-to-date investment data, empowering you with total control, transparency, and peace of mind.

Discover how PrizmaDesk can assist in safeguarding your family office for the future. Request demo access or Schedule a conversation with one of our wealth technology experts to join the community of clients who have harnessed the complete potential of their wealth today.

Receive Insights on Wealth Technology

Stay informed with the latest wealth tech insights and industry best practices delivered directly to your email.