CASE STUDY: How PrizmaDesk Revolutionized Wealth Management for White Whale Capital

Wealth management, especially for family offices and high-net-worth individuals, has never been easy. The process of managing complex and diversified wealth is often riddled with challenges, from staying on top of market trends to maintaining the trust of clients. However, with the emergence of innovative solutions such as PrizmaDesk, asset managers can now simplify their workflow and provide better services to portfolio owners.

The following case study delves into how PrizmaDesk, a pioneering wealth management platform, has transformed the day-to-day operations of White Whale Capital (WWC) and enriched the experience of its portfolio owners.

The Challenge: A Landscape Riddled with Inefficiencies at WWC

White Whale Capital, a mid-sized single-family office located in Luxembourg, faced significant challenges in managing complex and dispersed client portfolios. However, this is a simplified version of the issue; the actual day-to-day challenges were far more complex and varied. Tasked with asset management across multiple markets, utilizing various instruments through different banks, brokers, and exchanges, WWC’s team of asset managers found themselves dealing with a plethora of inefficiencies.

The manual aggregation and consolidation of data was not only a time-consuming process – often devouring two hours of each working day – but also prone to errors. This adversely impacted WWC's portfolio structures, elevated risk, and undermined performance. It also detracted from the time that WWC asset managers could spend on strategic decision-making.

Moreover, the absence of real-time portfolio insights was a significant handicap. The arduous task of computing performance and risk metrics for complex portfolios demanded constant attention and updates. Cash positions (all in various currencies) and all interest-bearing instruments were not included which made WWC's ability to measure performance virtually impossible.

Reporting was mired in inefficiency and without performance measurements, WWC's asset managers were unable to understand how specific asset allocation strategies were performing and did not have a grasp on their successes and risks. Perhaps most worryingly, they could not even convey portfolio performance to their clients. Additionally, the oversight of investment fees presented challenges, with overcharges leading to financial losses.

For WWC's portfolio owners, the situation was equally problematic. The lack of an easy-to-understand and accessible overview of their wealth was a growing concern. The desire for real-time access and greater transparency in their asset manager's activities was also a need, or more accurately, a demand.

The PrizmaDesk Objective: Provide a Transformative Wealth Management Solution for WWC

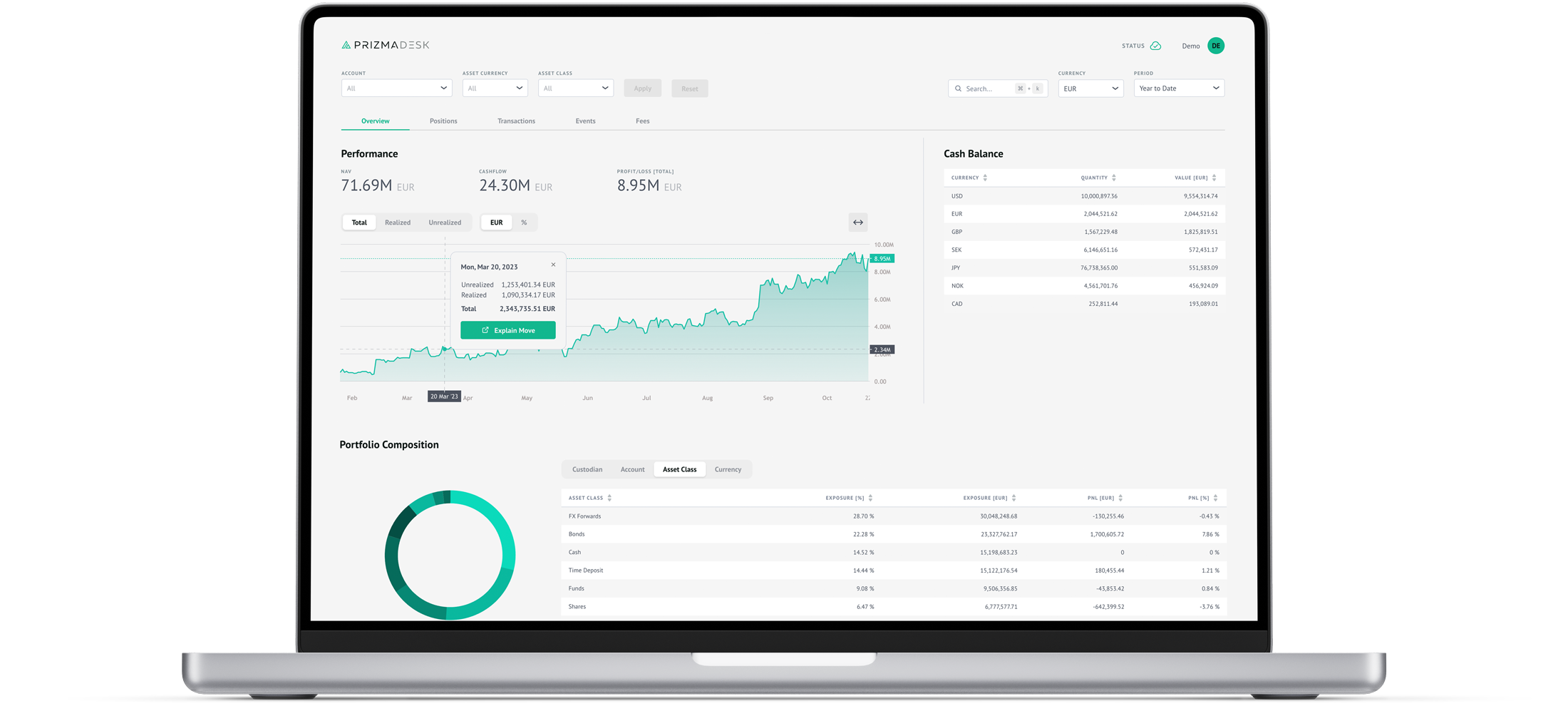

PrizmaDesk's goal was to provide a comprehensive and integrated solution to the challenges facing WWC through efficient workflow tools.

1 - White Whale Capital wanted a portfolio management system that would automatically gather data and integrate it into a unified, user-friendly platform, ensuring accessibility for all relevant stakeholders.

*This image is symbolic.

2 - WWC also wanted the ability to oversee securities holdings, categorized by sectors, geography, and market capitalization, as well as manage cash positions for each custodian. Additionally, WWC's asset managers wanted a comprehensive view of entire portfolios, encompassing both listed and unlisted securities and cash positions, complete with performance metrics and reporting capabilities.

3 - It was also imperative to White Whale Capital that its reporting capabilities need to be enhanced, ideally providing performance and risk metrics as well as customizable reports to suit different stakeholders' needs.

The Tangible Impact at White Whale Capital

The implementation of PrizmaDesk at White Whale Capital has been monumental. WWC asset managers now have a comprehensive solution that simplifies their workflow, saves time, minimizes risk, and enhances their capabilities in managing complex portfolios.

1. Efficiency in Data Management: The PrizmaDesk platform's core strength lies in its ability to automatically aggregate, validate, and standardize data from multiple sources in real-time. This feature significantly reduced the time WWC's asset managers spent on manual tasks, minimizing errors, and allowing more time for strategic planning. The ability to access real-time data led to more informed and timely decision-making, while the streamlined process of calculating performance metrics meant a dramatic reduction in the time spent managing data and also enhanced accuracy.

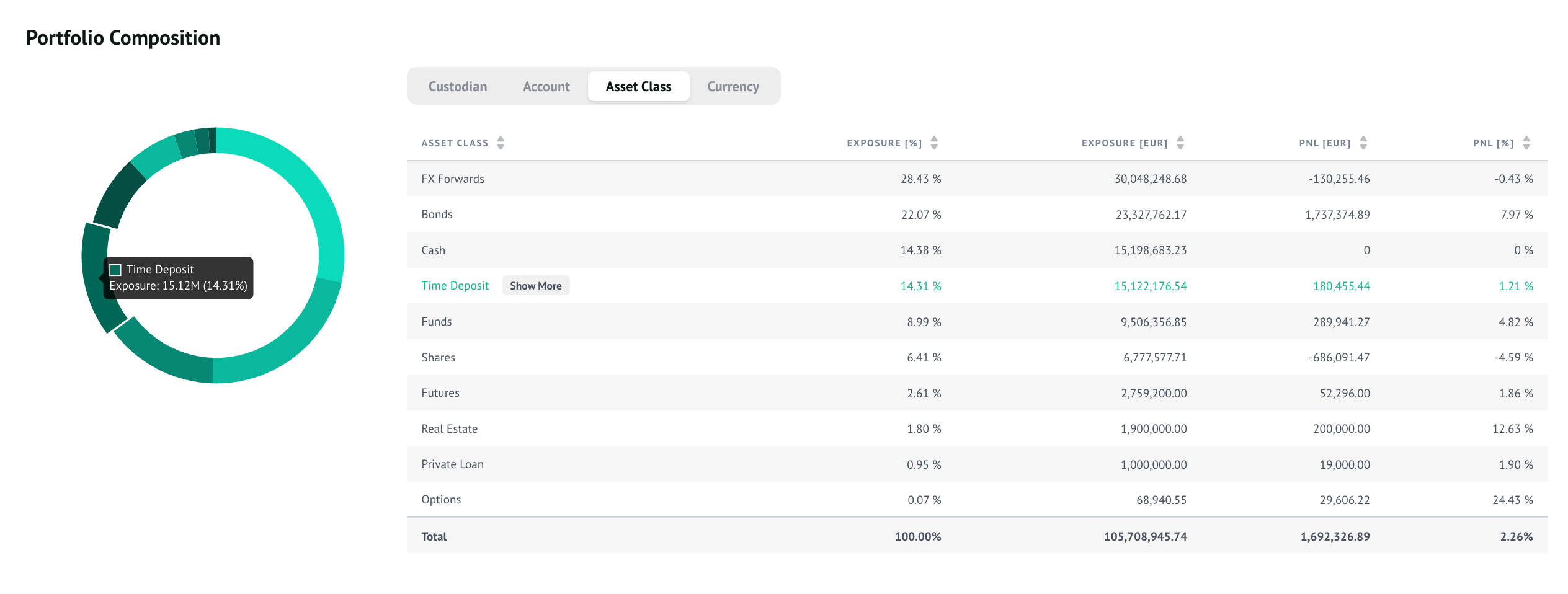

2. Capitalizing on Opportunities: PrizmaDesk's dynamic portfolio insights module provided WWC's asset managers with a comprehensive overview of their portfolios. Real-time analytics and risk calculation tools helped them manage complex and diversified portfolios more efficiently, with the ability to drill down into specific segments and asset classes. Managing securities and cash positions across various sectors, geographies, and market caps became more manageable, and having a unified view of their portfolios, including both listed and unlisted securities, along with cash positions streamlined WWC's portfolio management, offering clarity and control over their diverse investments.

*This image is symbolic.

3. Improved Reporting Efficiency: PrizmaDesk also addressed the reporting challenges at WWC by offering a dynamic and intuitive report-generation tool. The platform's automated performance reports provided up-to-date information on investments for portfolio owners on their investments. On the financial front, the effective tracking and management of investment fees resulted in significant cost savings, with one notable instance of saving a client over $40,000 annually.

For WWC's portfolio owners, PrizmaDesk offered a window into their financial world like never before. The platform provided a comprehensive, easy-to-understand view of their wealth, accessible anytime and anywhere. This led to increased transparency and more strategic discussions. Ultimately, this level of access fostered a deeper sense of trust and confidence in the asset manager's services.

*This image is symbolic.

PrizmaDesk - Redefining Wealth Management at White Whale Capital

The results of using PrizmaDesk at White Whale Capital are clear – improved efficiency, enhanced transparency, decreased risk, and increased returns. PrizmaDesk redefined not just the operational aspects of wealth management at White Whale Capital; it reshaped the very dynamics between asset managers and portfolio owners. With its efficient workflow tools, real-time data insights, and dynamic reporting capabilities, PrizmaDesk has revolutionized how WWC manages complex and diversified portfolios.

The fact is, the workflow challenges faced by WWC were not unique; most family offices have similar struggles, which often lead to missed opportunities or subpar performance. For more information on how PrizmaDesk can transform your wealth management workflow, visit our website, or contact us today.

About PrizmaDesk

PrizmaDesk is a wealth analytics platform that provides a full-picture view of your entire investment portfolio. With PrizmaDesk, you get a single source of accurate, up-to-date investment data, empowering you with total control, transparency, and peace of mind.

Discover how PrizmaDesk can assist in safeguarding your family office for the future. Request demo access or Schedule a conversation with one of our wealth technology experts to join the community of clients who have harnessed the complete potential of their wealth today.

Explore PrizmaDesk

We're excited to explore how PrizmaDesk can cater to your needs. Please complete the form below and one of our representatives will contact in you 24 hours.